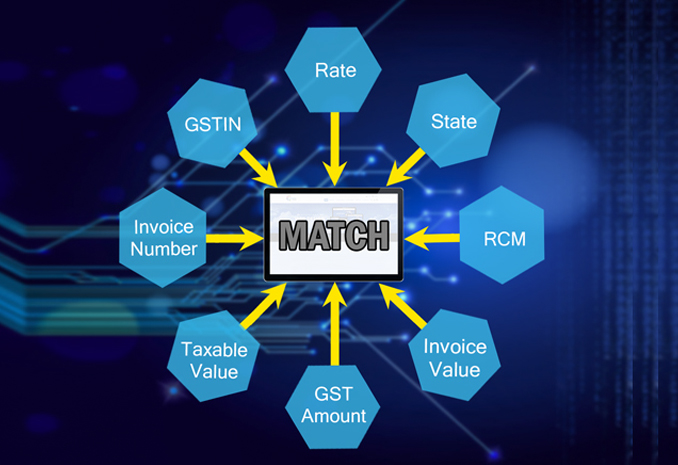

Invoice matching is very important because under the GST law, the input tax credit (ITC) of goods purchased or services taken will be available only when you have B2B invoice/bill from your supplier. All your inward invoices are shown in your GSTR-2A downloaded from the GST portal which were uploaded by your supplier in his GSTR-1. Now you have to match your inward supply invoices’ details with your GSTR-2A downloaded from the GST portal.

When the supplier files form GSTR-1, the recipient can identify the purchase with the help of auto populated form GSTR-2A. when necessary modifications are done, the recipient’s electronic credit ledger will be credited with the input credit on a provisional basis.

There are number of reasons for mismatch of information in your data and data from GST portal, with the help of 9y9GST-Match Application you can match your data with your GSTR-2A data and identify the mismatch reason and rectify your invoices, if required, or you can ask your supplier to modify the invoice details in his GSTR-1, so that you can take the correct input of your inward supplies or goods.

This matching exercise should be done on monthly/quarterly basis to get eligible input credit of GST paid by you and after end of the financial year you have to match again for the purpose of filing Annual Returns GSTR-9/GSTR-9C.

Following Reports are generated with this Application (It does not have its own Data source therefore generate Reports for each Taxpayer)